Daily Technical analysis for May 12, 2021

EUR/USD

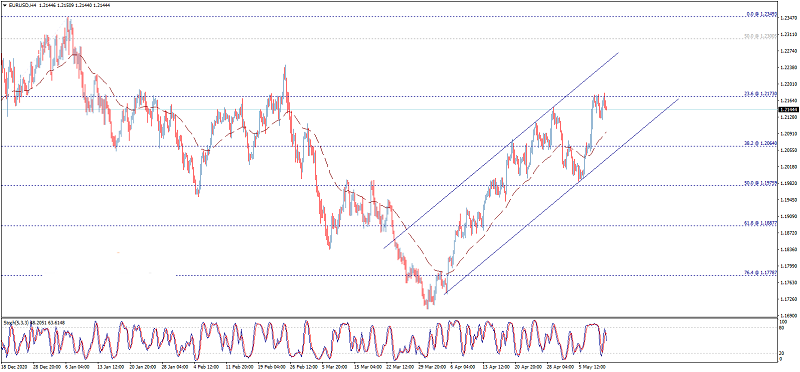

The EURUSD awaits the breach

The EURUSD pair shows more attempts to breach 1.2170 level but it finds difficulty to confirm the breach, to show some temporary bearish bias now, affected by stochastic negativity, waiting to resume the positive trades to open the way to head towards our next main target that reaches 1.2300.

On the other hand, we should note that breaking 1.2135 will press on the price to achieve more decline and test 1.2064 areas before determining the next destination clearly.

The expected trading range for today is between 1.2064 support and 1.2230 resistance.

The expected trend for today: Bullish

GBP/USD

The GBPUSD is stable

The GBPUSD pair did not show any strong move yesterday, to remain stable above the main bullish channel’s support line, supported by the EMA50, waiting to head towards 1.4238 that represents our next main target.

Note that breaking 1.4100 will stop the expected rise and press on the price to start correctional bearish wave on the intraday basis.

The expected trading range for today is between 1.4060 support and 1.4220 resistance.

The expected trend for today: Bullish

USD/JPY

The USDJPY resumes the negative trades

The USDJPY pair traded negatively yesterday to touch 108.35 level, showing some slight bullish bias now, noticing that the EMA50 continues to press negatively on the price, to remain stable inside the bearish channel that appears on the chart.

Therefore, our bearish overview will remain valid and active for today unless the price rallied to breach 109.22 level and holding above it, reminding you that our main waited target is located at 107.70.

The expected trading range for today is between 107.90 support and 109.00 resistance

The expected trend for today: Bearish

Gold price keeps its positive stability

Gold price faced temporary negative pressure yesterday to attack 1825.00 level, but it bounced bullishly to settle around 1838.00 level again, to keep the bullish trend scenario valid and active on the intraday and short term basis, which targets 1855.00 followed by 1865.00 levels as next stations.

The EMA50 keeps supporting the suggested bullish wave, which will remain valid conditioned by the price stability above 1825.00.

The expected trading range for today is between 1820.00 support and 1855.00 resistance.

The expected trend for today: Bullish

Source: Technical analysis

Comments (53)

… [Trackback]

[…] There you will find 70448 additional Information to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Info here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Information on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Info to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Here you can find 29980 more Info to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More on to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Info to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More on to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Info here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Find More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Info to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Information to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

Thank you for great information. I look forward to the continuation.

For the reason that the admin of this site is working no uncertainty very quickly it will be renowned due to its quality contents.

Pretty! This has been a really wonderful post. Many thanks for providing these details.

This is my first time pay a quick visit at here and i am really happy to read everthing at one place Watch bbc farsi

I really like reading through a post that can make men and women think. Also thank you for allowing me to comment!

… [Trackback]

[…] Read More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

I m often to blogging and i really appreciate your content. The article has actually peaks my interest.

I m going to bookmark your web site and maintain checking for brand spanking new information.

… [Trackback]

[…] Read More on to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More Info here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] There you will find 34154 additional Information on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

o great to find someone with some original thoughts on this topic. dubai racing 2

… [Trackback]

[…] Find More Information here to that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

Scrap collection services Scrap aluminum Aluminium scrap cleaning

Precious metal recovery, Aluminum cable stripping, Scrap metal price fluctuations

Metal waste supply chain Aluminum recycling systems Aluminium scrap remanufacturing

Data analytics in scrap metal industry, Aluminum cable scrap transportation, Metal salvage yard solutions

Metal waste reuse Aluminum scrap separation techniques Aluminium scrap derivatives

Metal scrap sourcing, Aluminum wire cable, Scrap metal export regulations

Sustainable scrap metal operations Scrap metal reclamation and reutilization services Iron scrap reclaiming

Ferrous metal repurposing and reclaiming, Iron waste disposal, Metal recycling and redistribution

Scrap metal inventory tracking Ferrous scrap reclamation services Iron scrap transport

Ferrous metal scraps, Iron scrap recovery and reclamation, Metal waste supply chain

Metal reusing services Ferrous metal waste recycling Iron scrap recovery facilities

Ferrous material recycling predictions, Iron scrap inspection, Scrap metal recovery and recycling center

… [Trackback]

[…] There you will find 79191 more Info on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

Metal waste reclamation plant Ferrous material recycling market Iron reprocessing services

Ferrous metal recycling company, Iron scrap recycling industry, Metal pricing services

Metal recycling and recovery services Ferrous waste processing plant Iron salvage yard

Ferrous material recovery centers, Iron reprocessing and repurposing, Metal reclaiming Yard

Metal reutilization facility Ferrous material trade restrictions Iron reclamation solutions

Ferrous material value-added processes, Iron waste reclaiming and repurposing, Metal waste collection

… [Trackback]

[…] Read More Info here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

официальная медицинская клиника онлайн в Москве купить справку без прохождения врачей купить медицинскую справку из поликлиники задним числом официально

… [Trackback]

[…] There you will find 55867 additional Information on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More Information here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]

… [Trackback]

[…] Read More Info here on that Topic: dayfinanceltd.com/daily-technical-analysis-for-may-12-2021/ […]