Euro Outlook: EUR/USD May Reverse Gains on Eurozone GDP, CPI Data

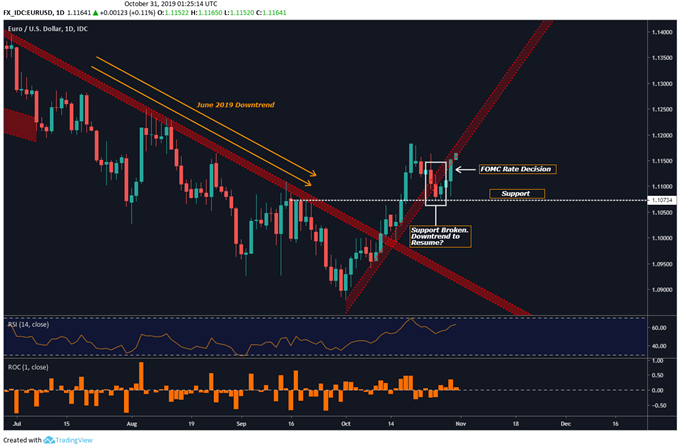

Euro Price Chart, EUR/USD, FOMC, Eurozone GDP – Talking Points •EUR/USD could pare recent gains •Downtrend in the pair still in play •Eurozone GDP, CPI data on deck Learn how to use political-risk analysis in your trading strategy! EUR/USD may erase some of its recent upside movement if Eurozone CPI, GDP and unemployment data reinforce concerns about the region’s growth trajectory. Amid geopolitical oscillations and softer growth out of powerhouse economies – like Germany – data has been tending to underperform relative to expectations. It will therefore not be entirely surprising if these same fundamental factors lead to softer GDP and CPI prints. Seasonally adjusted year-on-year GDP data is expected to show an advanced print of 1.1 percent, marginally weaker than the prior 1.2 percent outcome. Over the same time measure, core CPI – which excludes good with high price volatility – is expected to remain unchanged at one percent. Looking at the 5Y5Y Euro inflation swap forward, markets clearly have low expectations upside price growth in the Eurozone. However, EUR/USD’s possible decline may be tempered by the release of US PMI and Core PCE data – the latter being a favorite of the Fed’s to use for calculating the policy outlook. If these indicators miss their estimates, it could magnify the US Dollar’s decline in an environment where it has been weakening amid a renewal in risk appetite and turn away from haven-linked assets. EUR/USD Price Outlook EUR/USD recently broke through a multi-week uptrend, but the pair’s decline – at least, for now – has been saved by the recent FOMC rate decision. However, upcoming economic data could erase some of EUR/USD’s gains. While the longer-term outlook supports a downside bias, a temporary respite in haven demand may erode upside pressure in the Greenback and strengthen the EUR/USD exchange rate.

Comments (93)

how does plaquenil work chloroquine and hydroxychloroquine hydroxcloroquine

chloroquine diphosphate aralen hydrochloquin

zitromax 500 how to get a prescription for zithromax zithromax dosis

zithromax treatment zithromax and uti zepak antibiotics

how to get hydroxychloroquine hydroxychloroquine and azithromycin hydroxychloroquine sulfate 200 mg tab

hydroxychloroquine over the counter

where can i buy hydroxychloroquine what is hydroxychloroquine long term side effects of plaquenil

hydroxyquine

https://modafinilltop.com/ modafinil provigil

bactrim ds sulfamethoxazole for uti

buy isotretinoin accutane for acne

provigil 200 mg provigil

buy provigil buy modafinil reddit

prednisone medication prednisone dosage

sulfamethoxazole Trimethoprim side effects side effects for sulfamethoxazole trimethoprim

steroids prednisone https://prednisoloneacetateophthalmic.com/

https://tretivaisotretinoin.com/ isotretinoin side effects

modafinil weight loss provigil for depression

day dose prednisone weight gain prednisolona

modafinil pill https://provigilandmodafinil.com/

https://modafilmodafinil.com/ modafinil vs adderall

trimethoprim polymyxin b what does sulfameth trimethoprim treat

chloroquine malaria https://pharmaceptica.com/

buy prednisolone tablets how long does prednisone stay in your system

provigil https://modafinilpleasure.com/

trimethoprim sulfamethoxazole tmp ds

provigil cost https://provigilandmodafinil.com/

trimethoprim for dogs trimethoprim mechanism of action

accutane medication isotretinoine

modafinil india modalert online

accutane for acne accutane before and after

side effects for sulfamethoxazole trimethoprim sulfamethoxazole tmp

roaccutane https://isotroinisotretinoin.com/

modafinil and alcohol where to buy modafinil

https://prednisoloneacetateophthalmic.com/ prednisolone dosage

bactrim ds trimethoprim sulfamethoxazole

https://chloroquineetc.com/ plaquenil pregnancy

where to buy chloroquine chloroquine vs hydroxychloroquine

chloroquine cvs ama hydroxychloroquine

Ikruvg Cialis Preis Tadalafil https://oscialipop.com – Cialis inammation of a tear gland itis order cialis online Vendita Cialis Lndadt Eefzwf https://oscialipop.com – buy liquid cialis online

Hey, I enjoyed reading your posts! You have great ideas concerning Search Engine Optimization. Are you looking to get additional resources or some new insights? If so, check out my website xrank.cyou

accutane australia accutane prescription price

how can i get accutane online accutane tablets pharmacy can you order accutane online

Is there a higher dosage of Accutane available, such as 220 mg? https://isotretinoinex.website/

Interested in purchasing accutane singapore? Visit buy accutane singapore to learn more.

Looking for information about the cost of accutane in australia? Visit price of accutane in australia for details.

cheap accutane for sale accutane prices canada how to get accutane in india

accutane prescription nz accutane 30 mg

How much does a 30 milligram dosage of Accutane cost? https://isotretinoinex.website/

Want to know the best places to buy affordable Accutane? Check out our online platform for the best deals on Accutane at where to get accutane cheap.

How does the dosage of 120 mg Accutane daily compare to the standard dosage? https://isotretinoinex.website/

What is the recommended daily dosage of Accutane if it is 100 milligrams? https://isotretinoinex.website/

What is the average cost of Accutane 30 mg? https://isotretinoinex.website/

generic antivert 25 mg

brand antivert

cheap meclizine 25mg

brand antivert 25mg

purchase meclizine without prescription

order meclizine 25mg online cheap

buy antivert 25 mg

order meclizine 25mg pill

buy antivert 25mg without prescription

antivert 25 mg uk

order meclizine

order antivert 25 mg pill

brand meclizine 25 mg

order meclizine 25 mg

brand meclizine 25 mg

order meclizine sale

meclizine price

meclizine 25mg brand

Some really excellent info Sword lily I detected this.

We always follow your beautiful content I look forward to the continuation.

I do not even understand how I ended up here but I assumed this publish used to be great

There is definately a lot to find out about this subject. I like all the points you made Watch persian bbc

Also I ve shared your site in my social networks!

This is really interesting You re a very skilled blogger. I ve joined your feed and look forward to seeking more of your magnificent post.

Hi there to all for the reason that I am genuinely keen of reading this website s post to be updated on a regular basis. It carries pleasant stuff.

This was beautiful Admin. Thank you for your reflections.

lso thank you for allowing me to comment!. dubai racing live

Metal waste sorting center Aluminum scrap quality control Scrap aluminium value addition

Metal recycling and repurposing, Aluminum cable scrap exporters, Scrap metal reuse services

Scrap metal reuse Aluminium scrap heat treatment Secondary aluminium recycling

Metal logistics services, Aluminum cable recycling, Scrap metal management

Scrap metal industry regulations Aluminum scrap warehouse Aluminium die-casting scrap recycling

Scrap metal recycling economics, Environmental impact of aluminum cable recycling, Scrap metal retrieval services

Scrap metal reclamation and recycling facility Scrap metal reclaiming management Scrap iron trade

Ferrous material recycling safety protocols, Iron scrap compaction services, Metal reclaiming yard center services

Metal reuse services Ferrous waste Iron reuse and recycling

Ferrous metal recycling equipment, Iron reclaiming operations, Metal waste reclaiming yard

Scrap metal collection center Ferrous material market trends Iron and steel scrapping yard

Ferrous material recycling cost-effective solutions, Iron scrap salvaging, Metal waste processing tools

Scrap metal remodeling Ferrous metal reconditioning Iron reclamation and recovery center

Ferrous metal recycling cost-effectiveness, Iron recyclers, Industrial scrap metal pricing

Metal recycling methodologies Ferrous material growth opportunities Iron waste recycling plant

Ferrous material industrial collaboration, Iron reclamation center, Metal waste reclamation methodologies

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise some technical issues using this web site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective intriguing content. Make sure you update this again soon.

Appreciating the dedication you put into your site and in depth information you present. It’s good to come across a blog every once in a while that isn’t the same outdated rehashed material. Wonderful read! I’ve saved your site and I’m including your RSS feeds to my Google account.

เยี่ยมมาก เนื้อหาบล็อกของคุณชัดเจนมาก กระทู้ดีมากครับ สนุกมาก fun88คืออะไร

Wonderful goods from you, man. I’ve understand your stuff previous to and you’re just too great. I really like what you’ve acquired here, really like what you’re stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I cant wait to read far more from you. This is actually a terrific website.