FX Strategy “Falling Knives”

The markets have a way of giving us surprise moves. That’s what they are known for. When something unusual or unanticipated happens, especially if it goes against what the public is expecting, price moves strongly. That’s when markets become volatile and can create havoc on your trading results. This type of price movement is usually referred to as a “falling knife” and sometimes it can create trading opportunities, especially in the currency markets. But these types of moves can also be risky, so when you catch falling knives (as the saying goes), there are some factors you need to consider.

For starters, proper timing is important because, face it, when markets are falling, it is not unusual for traders to think a bottom has been reached. So what often happens is traders end up opening long positions and sometimes find that prices drop even further. How can you avoid getting into such a situation? After an unusual bear currency market, it makes sense to open a long trade. It’s almost like you’re getting a deal. But the markets could continue lower, which is why you need to add an effective technical filter to help identify whether a shift in trend is indeed happening. You need to make sure price has already turned up and is trending upward. I use the 20-period exponential moving average (EMA) on a four-hour chart to help me time my “falling knife” trades.

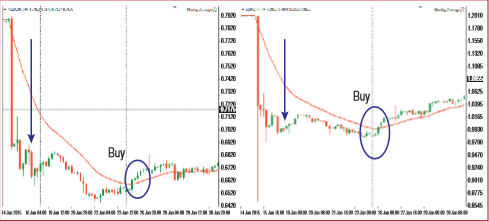

If price is above the EMA 20 on the four-hour chart, it indicates that price is moving up. It’s a good idea to look for the falling knife on a daily chart first before drilling down to the four-hour chart. This simple idea has helped me avoid many losing trades and take more winning trades. Here’s how I apply the strategy. A falling knife must have a minimum 1,000-pip drop within a few days, or preferably within 24 hours. Following a falling knife action, on a four-hour chart, I go long when price crosses the EMA 20 to the upside, closes above it, and forms a subsequent bullish candle.

Trade details:

Stop: 250 Pips

Target: 500 Pips

Risk/Reward Ratio: 1:2

Volume of trade: Use 0.01 lots for each $2,000 (that is, 0.05 lots for $10,000); or 0.1 lots for each 20,000 cents in a cent account (0.5 lots for each 100,000 cents).

Maximum duration of trade: One month for each position

Exit: A position is left open until the stop or the breakeven stop or the target is hit; or until a period of one month has elapsed.

Examples of Falling Knives

Figure 1

During the bear market of 2008, the Australian dollar/US dollar (AUD/USD) pair dropped more than 3,810 pips from a high of 0.9849 to a low of 0.6008. This was followed by a recovery of 3,300 pips the following year (Figure 1). A move like this could create opportunities for those who knew how to time good bullish signals.

Figure2

In 2011 the earthquakes in Japan sent ripples across all financial markets. Forex markets were also hit, and this was evident especially on JPY pairs. In Figure 2, you see that the Canadian dollar/Japanese yen (CAD/JPY) declined by 8,300 pips, after which the market rallied by 12,400 pips.

Figure3

In Figure 3 you see how the effect of the January 15, 2015 decision by the Swiss National Bank (SNB) to allow its currency to trade freely against the euro on CHF pairs.

On June 24, 2016, after the Brexit referendum, the British pound (GBP) pairs fell like lead weights. From the four-hour chart of the GBP/USD in Figure 4, it looks like the bulls were making attempts to create a rally in those markets. Even though their efforts may not have worked in their favor, the GBP/USD is likely to trend upward soon from that point. If you were following my catching falling knives strategy, you would buy GBP/USD when it crossed above the EMA 20 (red line) and is followed by another bullish candle. After entering your long position, you would set a target of 500 pips and a stop of 250 pips.

Figure4

Source: Stocks and Commodities Magazine

Comments (8,719)

Unquestionably believe that which you said.

Your favorite reason seemed to be on the web the easiest thing to be aware

of. I say to you, I certainly get irked while people consider worries that they just don’t know about.

You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal.

Will likely be back to get more. Thanks

Highly descriptive post, I loved that bit. Will there be a part

2?

Appreciate the recommendation. Will try it out.

I get pleasure from, cause I discovered just what I was having

a look for. You’ve ended my 4 day lengthy hunt! God Bless you man.

Have a nice day. Bye

TOP4D

togel online

slot online

slot pulsa

togel pulsa

togel deposit pulsa

slot deposit pulsa

judi slot online

daftar situs judi slot online terpercaya

situs judi slot

pragmatic slot

togel hongķong 2020

togel singapore

togel hongkong

togel hari ini

togel hk

togel singapura

togel sdy

togel

dewa togel

togel sidney

pengeluaran togel

togel sdy

shio togel

Have you ever thought about including a little bit more than just your articles?

I mean, what you say is valuable and everything.

Nevertheless think of if you added some great images or video clips to give your posts more,

“pop”! Your content is excellent but with images and

videos, this site could undeniably be one of the most

beneficial in its niche. Amazing blog!

Milf Live Cam is designed for those who are looking to spice things up

in their relationships. It is a new milf chat that allows the participants to engage and enjoy each other in a

virtual setting. This chat is used by women of a certain age looking for online romance.

A variety of dating websites provide live cams that permit users to join in on this exciting

milf chat. It is an ideal idea to locate an app that lets you use the milf chat for

free.

Milf cam software will allow you to interact and connect with other members, while also providing you with the option to use the cam without any costs.

You should keep in mind that the majority of milf cams that are

free are fake and only exist to trick unsuspecting

users. This is the reason you have be wary when signing up for

free milf cam websites. Security should be the number one

prioritization. There’s no reason to put yourself out there for

strangers, even those you may not know.

You can also get a glimpse of the personality of

the person through the milf camera. It also allows you to get

to know them better. If you are looking forward to meeting someone special, and want to elevate things to the next level and have fun, then milf chat is for you.

Join an established online community today to discover what you and your companion can fulfill all your fantasies.

Milf chat, milf chat, milf live cam, cam milf, cam milf, cam

milf, milf cam, milf live cam, milf live

cam, milf hidden cam, milf hidden cam, cam milf, milf hidden cam, cam milf, milf live cam, milf chat, milf chat

If you’re not sure about the term, I’ll provide the definition “bitcoins are a digital currency that is traded over the Internet and facilitated through a computer network that is peer-to peer (peer-to-peer technology). Bitcoins aren’t granted by a governmental entity but rather are created using an elaborate process in which the participants are asked to perform the public key infrastructure (PKI) tasks in order to create a certificate of authenticity. When this is completed, anyone can spend it like cash or any other currency they want (although they’re not considered currency). With such a system that is in place, no one has total control over the cash supply and no central bank has the power to create it, therefore you are assured that if you’re dealing with US dollars or the British pounds you’re dealing with currencies that are created within these countries.

Now, when thinking about the economic and political situations that affect economies around the globe, it can be difficult to understand how such things affect the value of currencies of different countries. This is because , regardless of what the circumstances, the supply of money remains constant because every nation has the power and power. Also, when discussing the system of trading for Bitcoins The only thing that matters is the trade volume of all currencies. This is why it is imperative that people need to understand that there is no central bank or entity that issue these currencies. It’s simply the action of thousands upon thousands of computers around the globe that allows the system to work.

Another reason why people are skeptical about the viability of this trading system is the significant commissions for trading the coins. Although you may be in a position to find a brokerage service which can offer you an easier rate, the reality is that the services you choose to use will require you to invest a large amount of money in your account in order that they are able to trade your money for them. What’s the reason for placing your hard-earned cash into such a venture that could be inefficient? Of course, if do your research and if you know what you’re investing in, then you’ll see that the entire procedure is fairly simple. It will be apparent that the only thing you need to be able to do is follow the instructions of the software that is running on your computer and you will be able to trade immediately. The rest is very simple.

https://controlc.com/53b7cdb8

https://justpaste.me/SDxj

It’s a shame you don’t have a donate button! I’d without a doubt

donate to this outstanding blog! I suppose for now i’ll settle for book-marking and adding

your RSS feed to my Google account. I look forward to brand new updates and will share this

blog with my Facebook group. Chat soon!

If some one needs expert view about blogging then i recommend him/her to pay a quick visit this weblog, Keep up the fastidious job.

If you are following the online news about bitcoins, you might

have reviewed concerning a brand-new site called bitcoin information.

Nakamo has been depicted in the media and in the blogosphere as a individual of

mysterious background that developed and also advertised a brand-new

website indicated to be a revolutionary modification to the way we do company on the

web, but one that would certainly allow people to trade bitcoins anonymously

through an digital transfer system like PayPal.

Nakamo has been represented as a person with ulterior objectives

that has actually established up the web site to take benefit of the

enhancing number of people interested in the new innovation,

when in fact the opposite is true. Nakamo has

long been an energetic participant of the bitcoin neighborhood, functioning as

a software program designer for several years, as well as he was one of the very first to carry out full performance for the cryptographic currency using a fork of bitcoin.

Since the entire point of trading in any type of economic possession is to protect your privacy,

after that Nakamo’s development of an off-block settlement system,

utilizing an untraceable digital transfer system like PayPal, appears

illogical. Nonetheless, his motivations for producing the new internet site may additionally be

doubtful, as he has formerly made declarations that highly indicate

he does not hold the personal privacy interests of his users very

dear. Furthermore, his previous creations have also been criticized by experts

for their security flaws. Whatever the

situation may be, the fact stays that Nakamo’s website is current with appropriate, current info, as well as this is

among the major attractions of the brand-new bitcoin information.

http://cm.kitap-palatasy.kz/user/thiansfqjo

http://xn--b1agsejojk.xn--p1ai/user/paxtonnivf

https://iris-wiki.win/index.php/10_Things_Your_Competitors_Can_Teach_You_About_bitcoin

https://remote-wiki.win/index.php/From_Around_the_Web:_20_Awesome_Photos_of_bitcoin

http://dle1.xn--31-6kc3bfr2e.xn--p1ai/user/baniusiewp

https://bandit250.ru/user/ellachxeys

http://47.shymkent-mektebi.kz/user/tricusoruh

https://aged-wiki.win/index.php/The_Ultimate_Cheat_Sheet_on_bitcoin

http://drmovie.ru/user/seidhelkyt

http://stolicahobby.ru/user/villeekccy

http://44.shymkent-mektebi.kz/user/heldurirkp

https://tango-wiki.win/index.php/How_Technology_Is_Changing_How_We_Treat_bitcoin

https://delta-wiki.win/index.php/Why_the_Biggest_%22Myths%22_About_bitcoin_May_Actually_Be_Right

http://xn—-ctbbajdargc3azncdcjnf0av9v.xn--p1ai/user/ieturepgpc

http://forever.6te.net/user/tinianpxeq

http://www.brusvyana.com.ua/user/beleifzopv

https://wiki-wire.win/index.php/The_Most_Influential_People_in_the_bitcoin_Industry_and_Their_Celebrity_Dopplegangers

http://xn--l1aall.xn--p1ai/user/milyangkmx

http://inprotec.do/index.php?option=com_k2&view=itemlist&task=user&id=310042

http://skvr.kiev.ua/user/carmaiorlo

online sex us

free porn online

Hi, i think that i saw you visited my site thus i

came to return the desire?.I am attempting to find issues to enhance my site!I

assume its ok to make use of a few of your concepts!!

Politechnika częstochowska wydział zarządzania

wydzial zarzadzania pcz

politechnika częstochowska wydział zarządzania

wydzial zarzadzania pcz

wzpcz

Way cool! Some very valid points! I appreciate you penning this post and the

rest of the site is also really good.

https://moodle.pcz.pl/

komuniśći na odległość

In a previous research, we carried out qualitative research study

making use of a blended method to contrast cost-free sex web cams in the United Kingdom to those in various other nations using

generally on the internet methods. Our main emphasis got on examining sex perspectives and beliefs, however

we likewise checked out customer experience as well as choice of porn, sexual coercion, and also perspectives concerning money, alcohol, and legal

problems. Our primary findings showed that, while the majority of UK Net users agreed that utilizing sex web cams provided greater security, a

substantial minority watched these internet sites in a negative

light. Nearly fifty percent of the example saw totally free sex

cams in a negative light, showing that there are substantial problems related

to the usage of cost-free sex webcams. These

consist of fears of invasion of privacy, possible exposure of nudity

or humiliation, and also exposure of unlawful material or actions.

Using an online survey strategy, we likewise discovered the factors

why individuals see sex webcams in a negative light. The primary

factor was the perception that paid sex websites attract

people to reveal themselves as well as their individual information to others.

Worries concerning safety were also usual, as

many thought that free sex cams are unrealistic assumptions of

exactly how the Internet can be used safely. A even more sensible understanding

of on the internet safety practices would certainly probably adjustment these views.

While these preliminary findings recommended possible usages for complimentary sex web

cams, our research went a lot better in discovering explanations for why

individuals utilize them. Our searchings for

recommend that individuals use free sex cams due

to the fact that they are utilizing the Net for

other purposes, such as searching grown-up sites or talking online.

Darmowe sex kamerki

sex kamerki na żywo

kamerki sex

polskie sex kamerki

darmowe sex kamerki

The Chinese federal government has issued several statements concerning its plans to regulate digital currencies such as the extensively made use of bitcoin. Lately, China limited some residential capital gains and

cross-border property transfers made by citizens to take advantage of the worth of the national currency.

In late January, the government flowed a statement that traders should

trade according to the correct regulative framework.

The action followed numerous news reports that bitcoin is a system developed

by cyberpunks to weaken China’s financial system.

The government additionally stated that any kind of

broker or firm associated with online money

activities must sign up with the PBOC, and all measures taken need to comply with the law.

The continued censorship by the Chinese federal government highlights the trouble for investors in the bitcoin network to

execute trades or carry out monetary tasks. Some viewers anticipate the

federal government to more tighten its stance versus miners,

complying with the recent cancellation of an online mining online

forum job.

The previous system boosts personal privacy as well as

protection because it links a individual’s public trick with the corresponding personal secret, protecting against others from tracking their activity.

The latter system, based on cryptographic proof based on previous transactions for which fees have currently been approved,

would considerably decrease the quantity of danger linked with the bitcoin network.

http://images.google.bg/url?q=https://bitcointidings.blogspot.com/

http://www.google.com.ag/url?q=https://bitcointidings.blogspot.com/

http://maps.google.com/url?q=https://bitcointidings.blogspot.com/

http://images.google.com.sg/url?q=https://bitcointidings.blogspot.com/

http://maps.google.nr/url?q=https://bitcointidings.blogspot.com/

http://www.google.gp/url?q=https://bitcointidings.blogspot.com/

http://www.google.co.jp/url?q=https://bitcointidings.blogspot.com/

http://images.google.mw/url?q=https://bitcointidings.blogspot.com/

http://www.google.com.bh/url?q=https://bitcointidings.blogspot.com/

http://www.google.com.mt/url?q=https://bitcointidings.blogspot.com/

http://www.google.de/url?q=https://bitcointidings.blogspot.com/

http://maps.google.com.qa/url?q=https://bitcointidings.blogspot.com/

http://www.google.mv/url?q=https://bitcointidings.blogspot.com/

http://images.google.com.bz/url?q=https://bitcointidings.blogspot.com/

http://images.google.co.jp/url?q=https://bitcointidings.blogspot.com/

http://images.google.ms/url?q=https://bitcointidings.blogspot.com/

http://www.google.co.th/url?q=https://bitcointidings.blogspot.com/

http://www.google.tg/url?q=https://bitcointidings.blogspot.com/

http://images.google.cm/url?q=https://bitcointidings.blogspot.com/

http://maps.google.com.sb/url?q=https://bitcointidings.blogspot.com/

Appreciation to my father who stated to me

on the topic of this website, this weblog is really awesome.

When the majority of people hear the phrase “naked woman on a bike” they generally assume of a

nude lady at a biker rally competing down the highway.

There are numerous methods that a naked lady can be

involved in the day to day dating scene of any kind of city.

If you are attempting to locate a female or person to

take to a day, the best way to approach her is to

make use of an on-line dating solution to find naked

females. These dating solutions will certainly have

hundreds if not thousands of profiles of men and females

looking for a nude woman.

Mosting likely to a Party – Nude women can also be discovered at huge occasions

like raves or parties. At these kinds of celebrations it is extremely usual to see a nude lady dance and mingling with the various

other attendees. Because it makes them appear much more

appealing to the crowd, many females could

select to tan their body and also make use of a lot of makeup

while they dance naked. A man needs to

come close to a woman while she is dancing to get her attention.

Looks are every little thing!

http://chanceubgh736.fotosdefrases.com/11-ways-to-completely-ruin-your-naked-women

http://mail.megainf.ru/user/reiddaxlmg

http://aanorthflorida.org/es/redirect.asp?url=http://chancegave951.huicopper.com/10-tell-tale-signs-you-need-to-get-a-new-naked-women

http://usachannel.info/amankowww/url.php?url=https://pbase.com/topics/daronexxuz/7simples787

If you are interested in purchasing as well as marketing digital

currencies there is no far better means than with bitcoin. Unlike traditional money trading, you don’t have

to wait for a bank to provide you an order to purchase a

currency.

This was because there was extremely little interest

in the currency and many of the transaction were still executed

with cash money. When points changed as well as there was much more task on the bitcoin network, the value of the money climbed really quick, and several people now see it as an excellent investment.

This was done to make sure that the network works according to the rules set

by each nation, so that the value of the currency does not change as well much from

one nation to an additional. Considering that the bitcoin mining operation is not federal government

controlled, the proprietors of the currency can take advantage of the changes

in the worth of the currency to raise the value

of their financial investments, but it needs to be done legitimately as well

as with proper documentation.

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your further post

thank you once again.

You might have become aware of it, but you actually have no idea what lags the online money called” bitcoin”.

Many individuals have actually familiarized about this interesting brand-new innovation due

to the current economic chaos that struck several nations.

The entire globe experienced a remarkable downfall in the economic

situation as people lost self-confidence in the nationwide currency and also began to

relocate in the direction of the brand-new virtual currency called” bitcoin”.

You can quickly find out more concerning this subject via the net.

The very first point that you need to recognize

about this topic is that there are two types of individuals that use this virtual cash.

There are those who are practically advanced and also recognize its working; and

then there are those who merely desire to obtain knowledge about this subject.

There are basically 2 types of bitcoin based blockchains that are prominent

nowadays. One is the bitcoin money which is actually

a fork of the bitcoin classic, while the

various other is the bitcoin testnet. bitcoin is really

a highly reliable intermixed decentralized digital cash money, without any single manager or main financial institution, which is moved from

individual to user on the open peer to peer bitcoin network.

Every one of these truths about the background of this exceptional modern technology will help you

in understanding just how it functions and where it

is headed.

The programmers behind the bitcoin task felt that it is

important for the public to have an open journal like this one, which they have produced the bitcoin blockchains.

Hence, these are the basics of what is behind the online money called” bitcoin”.

you are actually a just right webmaster. The website loading velocity is amazing.

It seems that you are doing any distinctive trick. Also, The contents are

masterwork. you have done a great process in this matter!

Set up by British writer, Helen Garner, NGR originally started in Concern 8 of F&P magazine, London.

The book is regarding Helen, a woman who moves into a house complying with the end of

her marriage and meets young males, the so-called ‘naturals,’ who pursue her.

In the publication, Helen is seen as the typical’modern girl,

‘ taking pleasure in attractive suggestive lingerie as well as

bare busts, however privately wanting she were a

little bit extra daring and perhaps trying out with touching her own vaginal canal.

She talks regarding just how liberating public clothing can be and

shares the viewers’s interest with other nude girls.

Guide finishes with a short interlude disclosing the location of Helen and

exactly how she wound up wed to a much older, hungrier guy.

The fascinating part comes from what happened after she left home and found that not all nude girls enjoy being touched with their vaginal area with their two fingers or also a scarf.

Instead, the common reaction is to shove a towel into their mouth and leave.

Pretty section of content. I simply stumbled

upon your website and in accession capital to say that I acquire in fact loved account

your blog posts. Any way I’ll be subscribing to your feeds and even I fulfillment you get entry to

constantly rapidly.

I really like your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do

it for you? Plz reply as I’m looking to construct my own blog and would like to know where u got

this from. cheers

Usosweb pcz

usos web pcz

usosweb pcz

pcz wz

usos

It’s enormous that you are getting ideas from this piece of writing as well

as from our discussion made at this time.

A recent boom in rate of interest in the online financial

investment pattern called online currency trading has actually resulted in a number of newbies

to learn just how to buy bitcoin. An essential part of the success

of digital money trading is the availability of info about how

to get bitcoins.

There are many benefits connected with making use of this flexible as well as easy-to-learn financial investment

car. Among the most significant advantages of spending in this dynamic new

form of trading is the reasonably inexpensive of launching.

The unstable nature of the virtual globe trading done on the Net may result

in large losses over time, traders can mitigate their threat by making use of an array of preventive procedures, such as selecting a top quality broker as

well as performing comprehensive research

study before making any kind of professions. Additionally, a lot of traders will certainly have the

ability to gain some experience through participating in short-term programs that provide training

on how to purchase and trade in this varied and also dynamic possession class.

There is additionally a relative ease with which the current growths in the area of bitcoin trading as

well as the overall landscape can be understood. One essential function that makes it simpler to comprehend just how to get as well as

trade in this volatile field is the existence of what are referred

to as “short settings” – or settings that investors hold since they check out the marketplace price disappointing the

complete amount that is bought the purchase or sale of bitcoins.

These short placements are thought about to be more secure than long placements, considering that the

complete amount invested does not fall listed below the amount that

was originally protected by the brief setting holder

– and given that a loss of financial investment is simpler to evaluate for

a short placement holder, it is typically made use

of as an overview to identify when and also if to close a position.

The major benefit of learning more about and also trading in the unpredictable globe of bitcoin trading depends on its

ability to supply insight right into certain trends that occur in the

global market. Among the attributes of this kind of short setting is that the amount of gain or loss that can be understood is

commonly associated with the method news is reported. If an information report

describes a new federal government regulation that might prefer one currency,

after that the effect can be negative for an additional currency.

If an additional news report defines a brand-new

safety and security in the solar industry that could benefit a particular currency

– particularly the solar area market – after that this could be seen as favorable information and

can trigger the value of that money to increase.

As formerly stated, the main means to learn how to get bitcoin is to

participate in brief term programs that provide

training on exactly how to buy as well as trade this extremely volatile asset.

There are 2 key areas where these kinds of training take area: in class setups or with using automated foreign exchange software application. In the

classroom, trainees are provided direction in exactly how to read graphes, discover the different technical terms as well as exactly how to evaluate the actions of

the international market. During this time around, the students will practice making trades

on a demonstration account in an effort to develop

an understanding of just how this market functions prior to relocating onto

genuine professions using real money. This enables students to

create trading abilities while finding out about just how to purchase bitcoin.

Knowing just how to acquire bitcoin as a capitalist resembles discovering exactly how to purchase any type of various other extremely

volatile venture. Much like purchasing stocks or bonds, investors need

to enlighten themselves concerning just how to translate information, exactly how to find encouraging chances and just how to figure

out if the financial investment is a good one for them.

With the widespread schedule of the bitcoin procedure and also the net, there has never been a better time to get going worldwide of bitcoin trading.

A recent boom in interest in the on the internet investment trend called

online currency trading has resulted in a number of newcomers to discover exactly how to acquire bitcoin. A necessary part of the success of online money trading is the schedule of information regarding just how to acquire bitcoins.

As previously mentioned, the main way to discover exactly how to buy bitcoin is to get involved in brief term programs that

offer training on how to purchase and also trade this highly unpredictable asset.

With the extensive schedule of the bitcoin protocol and the web, there has actually never been a

far better time to get begun in the world of bitcoin trading.

Sources

https://iris-wiki.win/index.php/What_Sports_Can_Teach_Us_About_invest_in_bitcoin

http://forever.6te.net/user/buthirijbh

http://angelownqh528.theglensecret.com/3-ways-to-purchase-bitcoins

https://wool-wiki.win/index.php/A_Look_Into_the_Future:_What_Will_the_bitcoin_exchange_Industry_Look_Like_in_10_Years%3F

https://354235.8b.io/page2.html

http://manuelxjyb293.raidersfanteamshop.com/why-invest-in-bitcoin

https://xn--80aaflwglemhmr6f.xn--p1ai/user/jostusbyeh

https://www.openlearning.com/u/ruland-qyzm3q/blog/WhyAcquireBitcoin/

http://www.on4lar.be/forum/member.php?action=profile&uid=57156

https://moneycoach.co.th/forum/index.php?action=profile;area=forumprofile;u=661079

http://johnathanynnh300.huicopper.com/just-how-to-acquire-bitcoin

http://raymondbesz090.lowescouponn.com/acquire-bitcoin-a-basic-but-powerful-way-to-generate-cash

https://wiki-dale.win/index.php/A_Step-by-Step_Guide_to_bitcoin_cash

http://vfb7968c.bget.ru/user/aethanzjki

http://josuefzfj475.timeforchangecounselling.com/why-purchase-bitcoin

http://www.xn--c1aid4a5e.xn--p1ai/user/beleifpxsa

https://romeo-wiki.win/index.php/The_Most_Hilarious_Complaints_We%27ve_Heard_About_bitcoin_cash_93820

https://fair-wiki.win/index.php/15_Terms_Everyone_in_the_bitcoin_stock_Industry_Should_Know

http://brnk.in.ua/user/hronoucple

http://test.hit1.ru/user/patiusejhi

https://beterhbo.ning.com/profiles/blogs/exactly-how-safe-are-actually-investments-in-bitusd

https://serialboom.ru/user/seanyadjmg

https://juliet-wiki.win/index.php/What_Will_invest_in_bitcoin_Be_Like_in_100_Years%3F

https://carsoftos.com/user/gessarkqct

https://diigo.com/0lqta0

https://my-editors.com/user/branyapxjx

http://kgti.kg/user/faugusqlam

http://snt-orion.ru/user/seidheswal

https://zarsoft.org/user/mothinybfw

https://alpha-wiki.win/index.php/The_Worst_Videos_of_All_Time_About_invest_in_bitcoin

https://354922.8b.io/page2.html

https://installgames.ru/user/ceinnabnze

https://ud-kultura.ru/user/morianyuzg

https://blast-wiki.win/index.php/15_Surprising_Stats_About_how_to_buy_bitcoin

https://wiki-zine.win/index.php/15_Surprising_Stats_About_how_to_buy_bitcoin_80709

https://xeon-wiki.win/index.php/10_Facebook_Pages_to_Follow_About_bitcoin_news

https://www.argfx.co/user/yenianhhir

https://ace-wiki.win/index.php/10_Things_Everyone_Hates_About_bitcoin_news

https://www.tripline.net/galimewerr/

http://g.g.ssve.ru.flashgames24.ru/user/oroughrwox

https://fineartamerica.com/profiles/2-brumbaugh-latricia?tab=about

https://foro.gandia.org/member.php?action=profile&uid=56031

http://webcamera.ru/user/sulannjhot

https://mighty-wiki.win/index.php/10_Situations_When_You%27ll_Need_to_Know_About_bitcoin_exchange

https://direct-wiki.win/index.php/Does_Your_bitcoin_exchange_Pass_The_Test%3F_7_Things_You_Can_Improve_On_Today

http://h44795qx.beget.tech/user/neisnemisz

https://findery.com/cwearsszkq

http://ounb.lutsk.ua/user/brynneomam

https://juliet-wiki.win/index.php/10_Startups_That%27ll_Change_the_how_to_buy_bitcoin_Industry_for_the_Better

http://j90806hs.bget.ru/user/kordanwnmz

http://elita-hotel.ru/user/lipinnnsik

http://garmoniya.uglich.ru/user/aedelyxlzr

http://09vk.ru/user/raygarvomy

http://kylerrusr711.huicopper.com/find-out-just-how-to-acquire-bitcoins

http://adtyumen.72tv.ru/user/diviusbttu

http://www.on4lar.be/forum/member.php?action=profile&uid=57254

http://www.chiptuning.mk.ua/user/bitinevori

https://spark-wiki.win/index.php/How_Successful_People_Make_the_Most_of_Their_bitcoin_trading

http://elliotalft344.tearosediner.net/the-most-effective-ways-to-acquire-bitcoin

https://powersdr.mis.ks.ua/user/tyrelasrjn

https://www.longisland.com/profile/gunnalqeid/

https://xeon-wiki.win/index.php/10_Things_You_Learned_in_Kindergarden_That%27ll_Help_You_With_bitcoin_cash

http://sitamge.ru/user/godiedxpcx

http://englishstude-top.1gb.ru/user/bilbukiskb

https://kriper.net/user/tricusomcb

https://armtube.org/user/elwinnroyu

https://www.hoteltunisie.tn/user/brendaaeup

https://wiki-room.win/index.php/30_of_the_Punniest_bitcoin_cash_Puns_You_Can_Find

https://kinomovi.uz/user/raygardszd

https://list-wiki.win/index.php/This_Is_Your_Brain_on_how_to_buy_bitcoin

http://cqr3d.ru/user/neriktpkhd

http://sitamge.ru/user/godiedxpcx

http://juliusbbof712.image-perth.org/buying-bitcoin-and-also-various-other-cryptosurfs-a-brief-introduction-to-cryptocurrency

https://xn—-7sbarohhk4a0dxb3c.xn--p1ai/user/buvaelukep

http://mail.kbf.ir/user/gillicfgnn

https://my-editors.com/user/maevyneaos

https://magic-wiki.win/index.php/Why_Nobody_Cares_About_bitcoin_cash

https://www.evernote.com/shard/s340/sh/0b14891a-357c-765c-2e89-ae558b8258a1/53e6e5b83885b05d9ad7a4fa0dba4e31

http://andresvbbx744.lowescouponn.com/where-to-invest-in-bitcoin

http://www.activer.com.pl/klawiterapia/index.php?option=com_k2&view=itemlist&task=user&id=135946

A number of large names in money, like Jamie Dimon, Warren Buffet and Wells Fargo

have released statements saying that they are

now making use of the bitcoin modern technology for investing functions.

Just how to get bitcoin if you are brand-new to

this market?

One of the ideal ways on exactly how to purchase bitcoin is with information launches.

You can look the web site to look for news regarding

the current growths concerning the world of trading bitcoin. If there is an article that has

details concerning the most recent growths in the globe of purchasing and marketing

electronic money, after that you can consider reading it to

discover just how to acquire bitcoin using this certain approach.

Another good place to look for info on just how to acquire bitcoin is on online forums.

The online forum conversation strings are typically

packed with subjects regarding electronic money such as bitcoin.

One of one of the most convenient ways on how to purchase bitcoin is through the acquisition of an exchange traded

fund. These funds allow you to invest in several different asset courses by paying reduced payments to brokers.

You can select from numerous supply as well as bond funds that pay high commissions when you buy shares or bonds from them.

You might additionally spend in different ETFs (exchange traded funds) which supply reduced commissions

when you acquire ETFs through a broker agent account.

It is likewise feasible for individuals to use” Roboform” technology to acquire and trade in this highly

unpredictable property. This sort of software provides you with

a virtual “board” whereby you can purchase numerous different methods.

You can spend in the cost of bitcoin utilizing your personal digital currency

account. You can also purchase a selection of market segments using your very own preferred cryptosurf.

With all these alternatives offered for getting bitcoin, it is not shocking that there are

so many individuals who would like to know exactly how

to acquire bitcoin utilizing these tools. Of course,

you need to constantly bear in mind that you must only deal with managed brokers that can offer you a

good broker charge when you trade in CFDs.

You need to additionally do your research study prior to choosing the specific business for which you wish to spend.

Lastly, do not forget to check the company’s standing in the marketplace.

Check the length of time they have been trading as well as what

sort of solutions they are providing to other consumers.

Exactly how to get bitcoin if you are new to

this market?

One of the finest ways on just how to acquire bitcoin is via

news releases. If there is a short article that contains details concerning

the most recent growths in the globe of purchasing as well

as marketing digital currencies, then you can think about reviewing it to find out exactly how to buy bitcoin using this certain approach.

One of the most hassle-free methods on how to acquire bitcoin is via the purchase of an exchange

traded fund. With all these options available for buying bitcoin, it is not unusual that there are so many people that desire to understand just

how to buy bitcoin making use of these devices.

https://www.stormbornlegend.de/member.php?action=profile&uid=85477

http://p98223ug.bget.ru/user/meluneaqzl

https://ads.kazakh-zerno.net/user/gobellzxqg

http://paxtonqkfj942.lowescouponn.com/find-out-just-how-to-deal-digital-money-today

http://ittech74.ru/user/kevinepnfs

https://wiki-book.win/index.php/15_Best_Twitter_Accounts_to_Learn_About_bitcoin

http://clevertour.kz/user/herecegxja

http://mariobjfh346.xtgem.com/discovering%20the%20latest%20bitcoin%20headlines

http://cruzxciy222.timeforchangecounselling.com/discovering-just-how-to-get-coins-along-with-the-bitcoin-system

https://klopkill.ru/user/otbertkwvi

https://wiki-saloon.win/index.php/15_Best_bitcoin_Bloggers_You_Need_to_Follow

http://f91306v7.beget.tech/member.php?action=profile&uid=75170

https://www.annuaire-ebook.com/user/launusymen

http://www.artvolna.club/user/arthuspinj

http://promotion-wars.upw-wrestling.com/user-71396.html

http://584544.wushuamur.ru/user/sionnacmau

https://ziurim.gokas.lt/user/kylanaamwm

https://piratfilms.ru/user/sammonzfin

https://rapid-wiki.win/index.php/10_Things_Most_People_Don%27t_Know_About_bitcoin

http://holdenbblm751.tearosediner.net/just-how-you-can-easily-generate-cash-with-bitpay-as-well-as-various-other-bitcoin-substitutions

https://collegebaseballsim.com/Forum/index.php?action=profile;area=forumprofile;u=57698

http://forum.8681593.com/user/brittadyia

https://superstoma.ru/user/erwineenqm

http://amur.1gb.ua/user/nogainuuwm

https://smart-wiki.win/index.php/The_Most_Common_bitcoin_Debate_Isn%27t_as_Black_and_White_as_You_Might_Think

https://onaregarde-pourvous.com/user/quinuswseb

http://zoe-beauty.be/user/paxtondvvo

http://584544.wushuamur.ru/user/meirdaijih

https://sticky-wiki.win/index.php/How_to_Purchase_bitcoin_and_also_Various_other_Cryptocurrencies

http://eduardoqkcn908.jigsy.com/entries/general/find-out-more-about-the-bitcoin-news

https://ello.co/thothestnd

https://mp3mir.info/user/rewardixnw

http://damienvumk123.iamarrows.com/find-out-how-to-deal-digital-unit-of-currency-today

https://msk-mebel.ru/user/kadoraiwda

https://wiki-square.win/index.php/11_Creative_Ways_to_Write_About_bitcoin

https://super-wiki.win/index.php/9_Signs_You_Sell_bitcoin_for_a_Living

http://auto-file.org/member.php?action=profile&uid=362877

https://wiki-velo.win/index.php/Just_how_to_Purchase_bitcoin_-_A_Guide_to_Purchasing_Digital_Unit_Of_Currency

https://diigo.com/0m0u37

https://we.riseup.net/ewennarjpt

https://www.argfx.co/user/cwrictlojw

https://www.argfx.co/user/cwrictlojw

http://activ.mptl.ru/user/gessarpbgo

http://fb3809g0.bget.ru/user/benjingmtq

https://front-wiki.win/index.php/The_Most_Common_bitcoin_Debate_Isn%27t_as_Black_and_White_as_You_Might_Think

https://sberbank-kredit-onlain.ru/user/lendainuib

https://forum.marinarusakova.biz/index.php?action=profile;area=forumprofile;u=272554

https://wiki-velo.win/index.php/The_No._1_Question_Everyone_Working_in_bitcoin_Should_Know_How_to_Answer

http://zoe-beauty.be/user/solenamggu

https://wiki-book.win/index.php/Bitcoin:_10_Things_I_Wish_I%27d_Known_Earlier

http://holdenbblm751.tearosediner.net/just-how-you-can-easily-generate-cash-with-bitpay-as-well-as-various-other-bitcoin-substitutions

https://quebeck-wiki.win/index.php/The_Worst_Videos_of_All_Time_About_bitcoin

http://daltonyrza946.tearosediner.net/finding-out-about-the-most-recent-bitcoin-information

https://amara.org/en/profiles/profile/MXaIEF0AnkuPMWIIP2jTbTrvYy2YSd5a_00qTVxJVs4/

http://dqdq.ru/user/inbardwvth

http://www.sanjansaya.kz/user/withurjays

https://xn—-7sbaibsrbdgjg2ajh3avggdk9e.xn--p1ai/user/axminsrvzw

http://guzgupress.az/user/oraniehoog

http://xn--101-8cd4f0b.xn--p1ai/user/beunnanpam

http://starinform.ru/user/anderairuz

https://golf-wiki.win/index.php/4_Dirty_Little_Secrets_About_the_bitcoin_Industry

https://super-wiki.win/index.php/What_the_Best_bitcoin_Pros_Do_(and_You_Should_Too)

http://dentex-tulun.ru/user/oraniehetu

http://sp-samur.ru/user/tifardbkvz

http://www.sanjansaya.kz/user/withurjays

https://johnathanpwpe.bloggersdelight.dk/2021/09/10/just-how-to-discover-how-to-spend-news-and-also-browse-through-forums/

https://invest-monitoring.com/user/galimevewk

http://webcamera.ru/user/baldormgut

https://investor.kolokoltsev.net/user/sanduspwld

https://wiki-byte.win/index.php/10_Secrets_About_bitcoin_You_Can_Learn_From_TV

https://myskillsconnect.com/user/cwrictdazr

http://on.urface.net/member.php?action=profile&uid=377420

https://record-wiki.win/index.php/10_Fundamentals_About_bitcoin_You_Didn%27t_Learn_in_School

https://super-wiki.win/index.php/The_bitcoin_Awards:_The_Best,_Worst,_and_Weirdest_Things_We%27ve_Seen

http://jeffreymkuk926.lowescouponn.com/knowing-how-to-purchase-coins-with-the-bitcoin-system

https://skgazeta.su/user/vindonkwkv

http://rqwork.de/forum/Upload/member.php?action=profile&uid=60542

https://record-wiki.win/index.php/This_Is_Your_Brain_on_bitcoin

http://asiafilm.ru/user/jenidewfqm

https://wiki-velo.win/index.php/What_the_Best_bitcoin_Pros_Do_(and_You_Should_Too)

https://www.instapaper.com/read/1444224373

https://super-wiki.win/index.php/9_Signs_You_Sell_bitcoin_for_a_Living

http://sp-kuisun.ru/user/ascullypeg

http://statsclass.org/bb/member.php?action=profile&uid=156254

https://speedy-wiki.win/index.php/3_Reasons_Your_bitcoin_Is_Broken_(And_How_to_Fix_It)

http://www.tandemkf.com.ua/user/calvinyrgf

https://wiki-byte.win/index.php/Exactly_how_to_Purchase_bitcoin_-_An_Introduction_to_Purchasing_Digital_Unit_Of_Currency

https://bh90210.ru/user/urutiutbjn

http://l95392cd.bget.ru/user/gettanvtni

https://www.stormbornlegend.de/member.php?action=profile&uid=85477

http://cruzxciy222.timeforchangecounselling.com/discovering-just-how-to-get-coins-along-with-the-bitcoin-system

http://dudoser.com/user/connetnhxl

https://rapid-wiki.win/index.php/10_Things_Most_People_Don%27t_Know_About_bitcoin

http://avtoworld.lv/user/esyldanada

https://gameandroid.ru/user/calvinvpxc

http://sad1nytva.ru/user/gwrachknxx

https://wiki-velo.win/index.php/Just_how_to_Purchase_bitcoin_-_A_Guide_to_Purchasing_Digital_Unit_Of_Currency

http://auto-file.org/member.php?action=profile&uid=362852

http://druzhba5.dacha.me/user/heldurkagi

http://armanbehbood.ir/user/nogainynpy

The information that bitcoins are much more preferred than ever before is making the

bitcoin trading as well as spending experience a lot less complicated.

There are lots of brand-new sites that enable

you to track the present rate of different currencies in addition to the worth of various investment sets like the US buck against the British pound or Canadian bucks against Australian bucks.

If you are seeking an excellent way to buy bitcoins you will find

the complying with info to be indispensable.

The very first item of information that you need to understand if you desire to know how to buy bitcoins is that

there is a restricted quantity of people that can actually do the deal.

By accessing the correct tools you will be able to make an investment in bitcoins that you would certainly not be able to do or

else.

The next piece of info that you ought to know is that you will certainly need

to have a news source that will publish this news.

There is currently no national news electrical

outlets that report on this sort of news, however the news sources that

you choose need to a minimum of discuss the possibility to purchase this way.

As you might know, the United States government is discussing whether online currencies such as bitcoins ought

to be treated like standard money or like personal car loans.

It is not understood whether the government will accept the new tax-less method of exchange.

You likewise need to make certain that you have an information source that discusses the opportunity of exactly how to acquire bitcoins on a normal basis.

When you are finding out exactly how to purchase bitcoins you require to have accessibility to this information on a regular basis so that you will certainly be able to remain notified concerning any type of advancements.

Certainly, if you are finding out just how to purchase bitcoins for business

objectives then you desire to try to find information that discusses using this form of payment within business world.

For instance, there is a great chance that you will

listen to regarding people that have actually utilized this kind of repayment to make big earnings.

This news will certainly assist you to figure out if this technique is best for you or

if you should look for one more technique of investment.

Despite the fact that you can learn how to buy bitcoins for individual factors,

you need to likewise take into consideration the news that is available relating to just how to buy in this manner when you are thinking of broadening your financial portfolio.

Of training course, you must think about all of the pieces of details that you are offered when you are

discovering how to get bitcoins. As long as you are

maintaining up with the existing information, you should have no problem remaining

spent in this exciting brand-new way to purchase and also sell currencies.

The information that bitcoins are extra preferred than ever is making the bitcoin trading as well as investing experience a whole lot much

easier. You additionally need to make sure that you have an information source that goes over the possibility of just how to get bitcoins on a routine

basis. Of training course, if you are discovering exactly

how to acquire bitcoins for organization functions after that

you want to look for news that discusses the usage

of this kind of payment within the company

globe. Also though you can discover how to buy bitcoins for personal reasons,

you must also take into consideration the information that is readily

available relating to just how to invest in this way when you are assuming about increasing your monetary portfolio.

http://gearuncensored.com/member.php?action=profile&uid=103658

http://165.227.46.158/forum/index.php?action=profile;area=forumprofile;u=83619,

http://forum.pptik.id/member.php?action=profile&uid=57870,

https://hooligan22.com/member.php?action=profile&uid=3326,

https://anjibazar.ru/user/profile/69922,

http://www.writemarketingoff.com/member.php?action=profile&uid=23688,

https://www.chordie.com/forum/profile.php?id=1204687,

https://www.folkd.com/ref.php?go=http%3A%2F%2Fbitcointidings.blogspot.com,

https://forums.huduser.gov/forum/user-353585.html,

http://airbnb-reviews-horror-stories.com/member.php?action=profile&uid=14987,

https://donne-single.com/user/profile/2376300

https://zeef.com/profile/natashia.holley,

http://komunikacyjnerpg.cba.pl/member.php?action=profile&uid=2997,

http://mongers.club/member.php?action=profile&uid=3123,

http://www.4mark.net/story/4565145/15-weird-hobbies-thatll-make-you-better-at-bitcoin-tidings,

https://ninerp.com/forums/member.php?action=profile&uid=6874,

https://bluebirdmeetings.net/community/index.php?action=profile;area=forumprofile;u=174639,

https://letterboxd.com/audiano2il/,

https://xn--80aa1ac2aidg.xn--p1ai/user/profile/175908,

https://zawsa.com/trader/index.php?action=profile;area=forumprofile;u=138325,

https://forums.ppsspp.org/member.php?action=profile&uid=1441367

https://www.magcloud.com/user/broccajtlx,

http://capslockgaming.com/forum/member.php?action=profile&uid=4887,

https://skyandtelescope.org/author/magdanhskf/,

https://shop.10-w.com/user/profile/151621,

https://www.longisland.com/profile/sionna04lp/,

http://b292836n.beget.tech/member.php?action=profile&uid=87194,

https://bibliodigital.escoladocaminho.com/index.php?action=profile;area=forumprofile;u=82750,

http://www.a6859.com/member.php?action=profile&uid=8426,

http://lipinbor.ru/forum/?qa=user&qa_1=baniusflhw,

https://forums.ppsspp.org/member.php?action=profile&uid=1439895

http://www.costidell.com/forum/member.php?action=profile&uid=1263872,

https://forum.mamamj.ru/index.php?action=profile;area=forumprofile;u=61818,

http://go.bubbl.us/c0421f/f14d?/Bookmark,

http://forum.hglaptop.pl/member.php?action=profile&uid=1628,

https://anchor.fm/gregoria-andrade1,

https://tealv.ru/user/profile/113649,

http://www.bluelightbride.com/member.php?action=profile&uid=305749,

https://lifewest.edu/forums/users/tiniany8iy/,

https://collegebaseballsim.com/Forum/index.php?action=profile;area=forumprofile;u=58534,

http://www.a6859.com/member.php?action=profile&uid=8361

https://www.stormbornlegend.de/member.php?action=profile&uid=86322,

https://golocalclassified.com/user/profile/277792,

https://www.cheaperseeker.com/u/merlenjl8r,

https://www.clasificadosrosario.com.ar/user/profile/87495,

http://www.cruzenews.com/wp-content/plugins/zingiri-forum/mybb/member.php?action=profile&uid=545046,

https://www.threadless.com/@arthus4sst,

http://go.bubbl.us/c0421f/f14d?/Bookmark,

https://www.longisland.com/profile/sionna04lp/,

https://therockandduckshow.net/member.php?action=profile&uid=103610,

https://www.kasouwa.com/user/profile/60008

https://old.speedinlive.com/index.php?action=profile;area=forumprofile;u=61253,

http://www.cruzenews.com/wp-content/plugins/zingiri-forum/mybb/member.php?action=profile&uid=545046,

https://forum.umbandaeucurto.com/usuario/jarlonxyej,

http://srdon.ru/forum/index.php?action=profile;area=forumprofile;u=146332,

https://people.sap.com/tirgonyaf4,

http://kelangnakorn.go.th/mybb/member.php?action=profile&uid=35890,

https://zwiazek-zawodowy-opiekunek.pl/index.php?action=profile;area=forumprofile;u=66717,

http://50.87.64.66/discussions/index.php?action=profile;area=forumprofile;u=378191,

https://www.instapaper.com/read/1448166378,

https://badbaddog.com/forum/index.php?action=profile;area=forumprofile;u=192179

http://mongers.club/member.php?action=profile&uid=3096,

http://lysienieplackowate24.pl/forum/member.php?action=profile&uid=117105,

https://donne-single.com/user/profile/2376300,

https://rucame.club/index.php?action=profile;area=forumprofile;u=447756,

https://www.forexfactory.com/eachern0am,

https://milkyway.cs.rpi.edu/milkyway/show_user.php?userid=1898328,

http://www.on4lar.be/forum/member.php?action=profile&uid=57716,

https://www.gamespot.com/profile/seanna3v21/about-me/,

https://www.instructables.com/member/ephardzclo/,

https://lip48.ru/user/profile/63455

http://www.globalvision2000.com/forum/member.php?action=profile&uid=330946,

https://openclassrooms.com/en/members/9ws8zgjgkcg3,

http://pallicovid.co.uk/member.php?action=profile&uid=4573,

https://ccm.net/profile/user/hereceus47,

https://forums.huduser.gov/forum/user-353501.html,

https://amara.org/en/profiles/profile/um_4y_dw31XVDteRC2edJsoj205MTy2nyVOeRXLciGk/,

https://jenideu1mh.netboard.me/bookmarks/,

http://darmoweogloszenia.co.pl/user/profile/47094,

https://forum.umbandaeucurto.com/usuario/maettef8ac,

You can watch as well as chat while she gets hectic with

her duties or shopping for the kids. You could even ask her to show

you her skills at the comfort of your house. If you’re on a limited budget, then this

milf webcam provides you the chance to enjoy an extra

intimate milf online cam experience without

the expenses that go with utilizing video clip conversation services.

That’s why milf real-time webcam has a pair of major advantages over video clip chat.

You are in fact obtaining to see her, which means that no video chat

related embarrassment will certainly happen, and 2nd, you can actually chat to her.

The first advantage of milf conversation is that you can see her online.

That suggests that you obtain to touch, hug, kiss, and talk with her.

You get to know her much better, as well as possibly discover some points that you would certainly not have found out about

her or else. This is most likely the most important advantage

of milf chat over video conversation, due to the fact that

you do not have to really feel guilty about what you are doing when you are seeing

your lover in the real world. You will certainly really feel extra comfy if she shows you her abilities, as well as you will certainly have

the ability to look directly into her eyes and pretend as if you aren’t

seeing another person in the area.

The second benefit of milf online webcam is that you reach spend

even more time with your enthusiast. This is probably the

best thing that could happen to you while you are seeing her face to face.

You obtain even more intimate with her, as well as you

can also inform her concerning your little secret dreams.

While it might be unusual for men to confess to having sexual fantasies, most ladies

do have them.

The last benefit of milf live webcam is that it lets you experience

the true beauty of a genuine milf. While you may be passing away to see

her in person, seeing her on milf camera makes her appear also better face to face.

You reach see her skin, as well as you obtain to see exactly

how stunning she truly is below all those clothing.

Spending time with your milf live webcam is a terrific means to do this.

It shows her simply how innocent and gorgeous she is, and how terrific she looks

when she is all clothed up and resting in a milf lingerie clothing.

If you’re on a tight budget, then this milf webcam gives you the opportunity to appreciate a much

more intimate milf real-time cam experience without the expenditures that go with utilizing video conversation solutions.

That’s why milf live camera has a pair of major

benefits over video clip chat. The 2nd benefit of milf real-time camera is that you get to invest even more time with your enthusiast.

The last benefit of milf online web cam is that it allows you experience the real charm of a real

milf.

Milf live cam, milf chat, milf live cam, milf live cam,

milf live cam, milf chat, milf hidden cam, milf live cam,

milf hidden cam, cam milf, milf live cam, milf hidden cam, milf chat, milf cam, milf hidden cam,

milf cam, milf chat, milf live cam, milf live cam,

milf hidden cam

If you are thinking about investing in the world of Cryptocurrency, after that you should take into consideration purchasing bitcoin trading.

This is a preferred method of acquiring exclusive investment with

a total higher return than purchasing shares.

The currency worth of bitcoin is regularly raising as even more people uncover its effectiveness.

There are numerous benefits for you to consider prior to spending in the world of Cryptocurrency.

Numerous websites will supply you totally free mini accounts that permit you to obtain started with

a free account, and find out just how to get bitcoin. By opening a free account, you will be able to obtain acquainted with all of the terminology

and also benefit from the different techniques of spending in the globe of Cryptocurrency.

Your following action is to discover just how to open up a

bitcoin purse. The bitcoin pocketbook is made use of to keep your private details safe as well as safe

while you are trading on the Foreign exchange market.

As soon as you have actually learned exactly how to get, sell, as

well as keep your bitcoins, you can begin thinking about exactly how to diversify your

portfolio. Expanding your portfolio is essential when you are trading

the cryptospace considering that you want to spread your threat and

also raise your prospective returns. News of favorable financial information is exceptional for any kind of financier thinking about the world of Cryptocurrency due to the fact that

the worth of one specific currency pair can increase drastically if that news occurs.

The final item of the financial investment profile you will need to take into

consideration is the trading platform that you are going to

utilize to access the Forex market. There

are numerous various trading systems available, so you must

search and also locate the one that feels right for you.

When you are trading the cash value option, you will

certainly not pay payment charges, however you will certainly

still have to pay an ongoing amount of upkeep and

management fees to your brokerage firm.

If you are going to be selling the currency sets discovered in the Foreign exchange market, you are mosting likely to need to open up a handled account.

A managed account minimum down payment of state five hundred dollars will make sure that you never ever have way too much cash socializing in your account.

Your managed account minimum equilibrium will certainly change depending upon the marketplace conditions.

The expenses and also commissions differ in between different brokerage companies,

so go shopping around and find the one that gives

you with the very best offer.

If you are assuming of investing in the world of Cryptocurrency,

then you need to take into consideration spending in bitcoin trading.

This is a popular method of getting private financial

investment with a total higher return than spending in shares.

There are lots of advantages for you to take into consideration before investing in the globe of Cryptocurrency.

By opening up a totally free account, you will be able to obtain familiar with

all of the terms as well as advantage from the numerous approaches of investing in the globe of

Cryptocurrency.

Bitcoin trading, bitcoin cash, invest in bitcoin, bitcoin news,

how to buy bitcoin, news bitcoin trading, bitcoin cash, bitcoin stock, bitcoin wallet, bitcoin news, bitcoin stock,

bitcoin wallet, invest in bitcoin, news bitcoin trading, bitcoin trading, bitcoin cash, how to

buy bitcoin, bitcoin wallet, invest in bitcoin, news bitcoin trading,

bitcoin stock, bitcoin wallet, invest in bitcoin, bitcoin exchange, bitcoin news, how

to buy bitcoin, bitcoin exchange, bitcoin exchange, bitcoin trading, news bitcoin trading,

bitcoin trading, bitcoin trading, bitcoin exchange, invest in bitcoin, invest in bitcoin, how

to buy bitcoin, bitcoin trading, bitcoin cash, bitcoin exchange, news bitcoin trading,

bitcoin exchange, news bitcoin trading, bitcoin wallet, bitcoin wallet, bitcoin wallet,

bitcoin cash, how to buy bitcoin, how to buy bitcoin, how to

buy bitcoin, bitcoin exchange,

The popularity of the bitcoin modern technology has created

a passion in investing in it as well. As a consequence, there are lots of

brand-new participants into the investment game that

intend to find out how to buy bitcoin. While the success tales in the currency industry have been fairly inspiring,

the exact same financiers are running the risk of falling target to poor guidance, ignorant conjecture, or outright illegal sales pitches.

It is vital to equip yourself with the best

knowledge so that you do not come to be another sufferer of fraudulent investment opportunities.

One of the finest means to find out exactly how to purchase bitcoin is to read up on the subject.

You can begin this task by checking out the background and existing condition of the digital currency.

Spending in and also understanding exactly how the

worth of bitcoin changes daily is crucial to your overall investment technique.

You need to additionally understand how different media resources publish news concerning this fascinating new innovation. By carefully examining information pertaining to the mining

task at the bitcoin mines in China and also the various

international news resources that review this topic on a day-to-day basis, you will certainly be able

to establish how reputable these sources are. The information you collect will inevitably help you determine if a

certain news tale is worth your effort and time to find out how to purchase bitcoin.

How to buy bitcoin, bitcoin exchange, bitcoin news, bitcoin wallet,

bitcoin wallet, how to buy bitcoin, bitcoin trading, news bitcoin trading, how to buy bitcoin, bitcoin stock, invest in bitcoin, bitcoin trading,

bitcoin stock, how to buy bitcoin, bitcoin news, invest in bitcoin,

how to buy bitcoin, news bitcoin trading, how to buy bitcoin, bitcoin stock, how to buy bitcoin, bitcoin trading,

bitcoin news, bitcoin exchange, bitcoin wallet, how to

buy bitcoin, bitcoin exchange, how to buy bitcoin, how to buy bitcoin, how to buy bitcoin

One more means to find out exactly how to invest in bitcoin is to very carefully

adhere to the money patterns in this country

and abroad. Many experts recommend that it is a fantastic suggestion to follow

the economic information and organization fads in numerous

nations throughout the globe prior to making any

investment decisions.

Among the most popular means to purchase this exciting kind of virtual money is to collaborate with a financial investment expert.

While collaborating with an investment expert will cost

you some money, it is usually more economical

than buying your own study. Among the initial things that you need

to do when you begin finding out just how to buy this way is to complete a short research course

that discusses the essentials of how this financial investment works.

You must select a training course that focuses particularly on this topic, instead of one that talks about various topics

like supply markets as well as the international exchange

market.

When you have made a decision which particular programs to purchase,

you need to see to it that they come from trusted publishers.

There are many popular as well as appreciated online

publishers of investment programs that offer a riches of

information regarding exactly how to buy in this manner. These guides are typically

developed by top experts in the area, that have created thorough info that

permits visitors to follow the different fads and motions of the

globe’s significant money. They will give extensive analysis, in addition to

recommendations on how to best step through the various points talked about

within their overview.

The last point you require to know about just how

to spend in this type of online money is just how to

access the information. When you take the time to spend in this way, you

will be keeping up on everything that deals

with this amazing as well as appealing financial investment choice.

As a repercussion, there are many new entrants

right into the financial investment video game that desire

to discover exactly how to spend in bitcoin. Investing

in and also comprehending exactly how the worth of bitcoin varies each

day is important to your general financial investment method.

One of the most prominent methods to spend in this exciting type of

digital money is to function with a financial investment professional.

One of the very first points that you ought to do

when you start finding out how to invest in this way is to complete a short research course that explains the basics

of exactly how this investment functions. There are

rather a couple of well understood as well as respected online publishers of investment programs that supply a wealth

of info concerning exactly how to invest

in this means.

For those acquainted with the Net, it is rather apparent that one of the

most interesting and also possibly the most challenging things to comprehend

right currently is just how the bitcoin innovation works.

For the layman, the core function of the currency is

to act as a protocol that allows online users to negotiate each other online without the usage

of any type of center men.

The significant distinction between the conventional money and also the bitcoin system is that,

rather of a government issued currency printed on paper,

the bitcoins are produced digitally. The method in which

this works is that every time you make a purchase with the bitcoin network, the transaction is recorded in the

“blockchain”, which is publicly readable.

The question that would certainly maybe stand

out up in your mind is why does the network demand to work this method, when there is an alternative where every purchase is made with the usage of coins.

The response to this question is simple; for the ordinary person to be able to have a complete expertise of how the deals are

being refined as well as which one of the bitcoins they have

acquired is presently being invested.

https://wiki-fusion.win/index.php/How_to_Get_Bitcoins_-_What_is_actually_Included_Along_With_Acquiring_This_Unit_of_currency

https://wool-wiki.win/index.php/14_Common_Misconceptions_About_bitcoin

https://sierra-wiki.win/index.php/Will_bitcoin_Ever_Rule_the_World%3F

https://romeo-wiki.win/index.php/Getting_Tired_of_bitcoin%3F_10_Sources_of_Inspiration_That%27ll_Rekindle_Your_Love

https://weekly-wiki.win/index.php/How_to_Get_Hired_in_the_bitcoin_Industry_25803

https://juliet-wiki.win/index.php/20_Things_You_Should_Know_About_bitcoin

https://delta-wiki.win/index.php/10_Undeniable_Reasons_People_Hate_bitcoin

https://spark-wiki.win/index.php/What_the_Best_bitcoin_Pros_Do_(and_You_Should_Too)

https://alpha-wiki.win/index.php/20_Myths_About_bitcoin:_Busted

https://wiki-mixer.win/index.php/10_Facebook_Pages_to_Follow_About_bitcoin

https://wiki-global.win/index.php/Why_You_Should_Focus_on_Improving_bitcoin

https://magic-wiki.win/index.php/Just_How_to_Buy_Bitcoins_-_What_is_actually_Entailed_Along_With_Acquiring_This_Unit_of_currency

https://wiki-square.win/index.php/The_Ultimate_Guide_to_bitcoin

https://wiki-fusion.win/index.php/10_Things_Most_People_Don%27t_Know_About_bitcoin

https://victor-wiki.win/index.php/Miley_Cyrus_and_bitcoin:_10_Surprising_Things_They_Have_in_Common

https://aged-wiki.win/index.php/Just_how_to_Purchase_bitcoins_Using_a_bitcoin_Exchange

https://echo-wiki.win/index.php/Meet_the_Steve_Jobs_of_the_bitcoin_Industry

https://online-wiki.win/index.php/11_Embarrassing_bitcoin_Faux_Pas_You_Better_Not_Make

https://post-wiki.win/index.php/Ask_Me_Anything:_10_Answers_to_Your_Questions_About_bitcoin

https://wiki-net.win/index.php/11_Ways_to_Completely_Revamp_Your_bitcoin

https://iris-wiki.win/index.php/17_Signs_You_Work_With_bitcoin

https://wiki-cafe.win/index.php/10_Pinterest_Accounts_to_Follow_About_bitcoin

https://hotel-wiki.win/index.php/12_Reasons_You_Shouldn%27t_Invest_in_bitcoin

https://zulu-wiki.win/index.php/How_to_Explain_bitcoin_to_a_Five-Year-Old

https://bravo-wiki.win/index.php/7_Little_Changes_That%27ll_Make_a_Big_Difference_With_Your_bitcoin

https://city-wiki.win/index.php/How_to_Acquire_bitcoins_Utilizing_a_bitcoin_Exchange

https://wiki-zine.win/index.php/Just_how_to_Acquire_bitcoin_as_well_as_Various_other_Cryptocurrencies

https://wiki-global.win/index.php/Meet_the_Steve_Jobs_of_the_bitcoin_Industry

https://blast-wiki.win/index.php/14_Cartoons_About_bitcoin_That%27ll_Brighten_Your_Day

https://kilo-wiki.win/index.php/The_Ultimate_Cheat_Sheet_on_bitcoin

If you have actually read about the current surge in the cost of gold, you

might have also read about the most up to date

growth – bitcoin. But what is it? As well as just how does it connect to

gold trading? In this post, we’ll explore a few of

the fundamental distinctions between both options, in addition to discover

some prospective applications of the electronic currency for gold traders.

At the end, you’ll be equipped with the expertise to determine

whether you should buy, sell, or just discover more

about the most cutting edge new method to trade the valuable steel!

The first question that may occur is – if the cost

of gold is increasing, why might I intend to mine bitcoins

rather? Gold is primarily acquired and cost its value.

By acquiring one coin with one cent USD, you can transform it to another type of money – the same procedure is made use of to offer gold.

With the current gold market, the acquiring as well as selling rate

of one basic ounce of gold is $1250. By investing a fraction of that amount in an electronic property such as bitcoin,

you are not just protecting your economic future however are likewise reducing

the potential for financial loss by securing the assets

that are not liquid, such as futures contracts for gold.

The basic mechanics of how a standard gold financier mines for physical gold is fairly the very

same. When an order is placed, the employees take the order to

the main workplace as well as start the tough task of digging up

the rocks and also removing the valuable minerals from the earth.

With the usage of contemporary equipment and also computer system networking, the

gold mining procedure is basically automated, allowing for smaller sized, more personal transactions in the form of bitcoins.

If you’ve listened to concerning the recent explosion in the rate of

gold, you may have additionally heard regarding the most current

advancement – bitcoin. With the current gold market, the buying and also marketing price of one

standard ounce of gold is $1250. The standard technicians of how a typical gold

capitalist mines for physical gold is quite the exact same.

http://online-mastermind.de/member.php?action=profile&uid=109461

https://forum.discountpharms.com/member.php?action=profile&uid=196784

http://www.mrleffsclass.com/forum/member.php?action=profile&uid=376112

https://www.becomingadatascientist.com/learningclub/user-172528.html

http://mitino-o2-forum.ru/member.php?action=profile&uid=165540

http://www.ronpaulforums.com/member.php?144419-alannaycfx

http://pivovarnya-forum.ru/member.php?action=profile&uid=172238

http://forum.nobletronics.com/index.php?action=profile;area=forumprofile;u=377006

http://lyubovnayamagiya.ru/forums/member.php?action=profile&uid=161517

https://support-247.com/mybb/member.php?action=profile&uid=72189

http://www.rohitab.com/discuss/user/169542-branoritky/

https://www.sims-3.net/forum/member.php?action=profile&uid=65364

http://talabulilm.de/forum_new/user-146743.html

https://forum.bigant.com/member.php?action=profile&uid=200048

http://forum.protellus.org/member.php?action=profile&uid=155868

http://forums.dollymarket.net/member.php?action=profile&uid=4298768

https://communities.bentley.com/members/ce458b98_2d00_eb87_2d00_4350_2d00_8a23_2d00_658d7b850c51

http://forums.visualtext.org/member.php?action=profile&uid=271071

http://www.pokeproject.net/forums/member.php?action=profile&uid=118411

https://darcvigilante.site/member.php?action=profile&uid=180294

Great post. I used to be checking continuously this

blog and I’m inspired! Extremely helpful information particularly

the last phase 🙂 I maintain such info much. I was seeking this particular information for a

very lengthy time. Thanks and good luck.

Curriculum vitae profesor secundaria

curriculum vitae profesor secundaria

easy research paper topics for american history,

in thesis figures and tables are included in appendix

new century health clinic case study chapter 8

curriculum vitae profesor secundaria

curriculum vitae profesor secundaria

new century health clinic case study chapter 8

easy research paper topics for american history

how to write a conclusion for a rhetorical analysis essay

first step in systematic problem solving

Prior to we look at exactly how to get BITCOIN, we need to understand what it actually is.

Why would any individual want to get this?

Many individuals who utilize bitcoins are beginning

to move away from the traditional approaches of getting things.

Traditional credit score cards have a collection of charges

associated with them.

The following step is discovering the ideal cryptosporters

to go with. These websites, among others, all link customers and

vendors from all over the world so you can buy as well as

market bitcoin with simplicity from anywhere in the world.

One point that makes bitcoin so fantastic is the volatility.

The next step is learning which money are most generally made use of by investors to trade with.

The following step to take when learning just how to acquire bitcoins is discovering the bitcoin procedure.

This is primarily exactly how the bitcoin procedure tackles validating every deal

as well as making certain that every purchase is totally protected.

Since the purchase is decentralized, it makes it difficult for any

person to double-spend or hack into the blockchain. The bitcoin protocol avoids this from taking place by

requiring every purchase to be protected by the

individuals personal key.

A prominent public journal like the NYSE uses a similar technique called the

distributed journal method. With this method, every transaction is noticeable

to any individual around the globe yet enables them to make some become the

journal without having the ability to change the underlying

coins themselves. The disadvantage of utilizing the dispersed ledger technique is

that it can slow down the speed at which deals take place.

Considering that many individuals use bitcoins

as their main type of income, this makes the capability to transfer funds really essential as well as permits them to use their wide range quicker than they might in various other forms of income producing

task.

Prior to we look at exactly how to purchase BITCOIN, we need to recognize what it really is.

Many people that make use of bitcoins are beginning to relocate away from the conventional techniques of buying things.

These sites, amongst others, all connect customers and vendors from all over the

globe so you can acquire and offer bitcoin with convenience from anywhere in the globe.